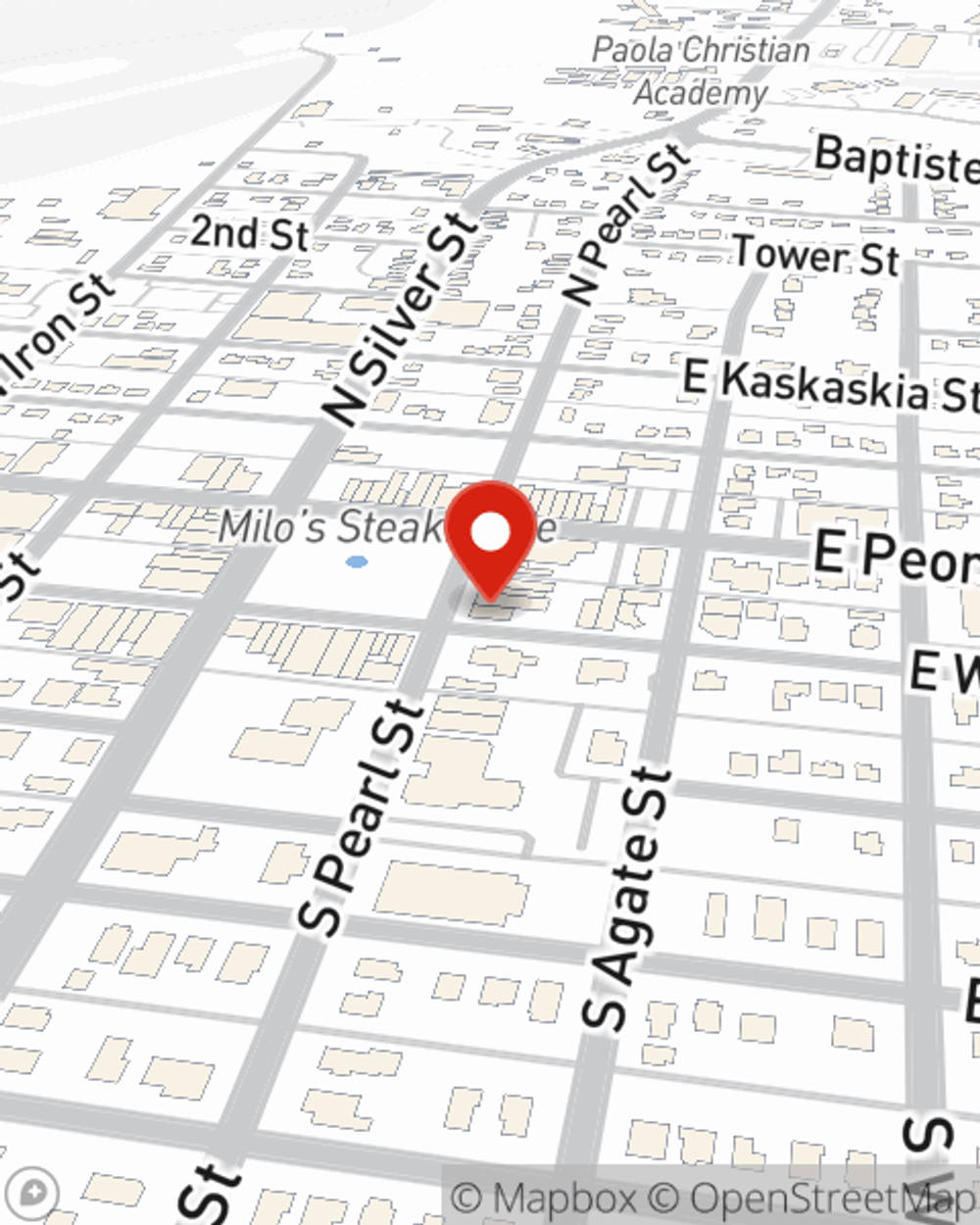

Business Insurance in and around Paola

Looking for coverage for your business? Look no further than State Farm agent Jim Adkins!

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to take into account. We understand. State Farm agent Jim Adkins is a business owner, too. Let Jim Adkins help you make sure that your business is properly insured. You won't regret it!

Looking for coverage for your business? Look no further than State Farm agent Jim Adkins!

This small business insurance is not risky

Get Down To Business With State Farm

Whether you are a painter a dentist, or you own a deli, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Jim Adkins can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and computers.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Reach out to State Farm agent Jim Adkins's team today to discover your options.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jim Adkins

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.